If you can increase your savings, your return or your annual salary, you’ll be well on your way. Now, $1.3 million may or may not work for a retired couple at age 45, but the point is that you can reach this level saving just 25% of your income, not 50%. If your income rises over time, as is typical, that final savings number will be even higher. If you start at age 25, that means you’ll retire at 45. If you can save even just 25% of your income and invest it at an 8% return, in 20 years you’ll have nearly $1.3 million saved. That puts your household at $100,000 in earnings per year. Imagine that you and your spouse each earn $50,000 per year, which is just below the average weekly wage of $984, according to the U.S. But do you absolutely have to save 50% of your income to retire early? Not at all. Yes, the more you can put away, the earlier you may be able to retire. Yes, you do need to put aside a large amount of savings to retire early.

Simple math early retirement how to#

How to set up your own perpetual income machine.Altria Delivers Dependable Dividend Growth and Hig.Use these tools within your control to get rich Front Loading Savings for a Successful Dividend Retirement How to retire in 10 years with dividend stocks I started out in my early 20s, and am pretty close to being financially independent by my early 30s. Starting out as early as possible helps tremendously too. However, we can somewhat control our savings rate, and the investments we make. We have no control over stock market returns, or expected dividend growth rates. What this exercise shows you is that you need to focus on things within your control, in order to reach your goals. This post was inspired by this article from the Mr Money Mustache blog. For those who strive to retire early, it is quite possible that they will exclusively rely on the income produced from their investments.

In most situations, a person would have pension income and social security income or even some part time job income to rely upon, when they retire.

It translates to basically 25 times expected annual spending. I am also assuming that this investment income is the only income to provide the essentials for a basic retirement income. As many of you know, Mister Money Mustache (MMM) wrote a blog post entitled The Shockingly Simple Math Behind Early Retirementthat if nothing else gives stock investors a very simple rough estimate to how much money they will need to retire. More complications are probably going to confuse people, rather than make it clear for them. I also am ignoring the effect of taxes on investment income, since everyone’s taxes are different, and I didn’t want to complicate too much this simple truth. I assume a “real salary” that does merely keep up with inflation, and investment returns that are also “real” and therefore are after inflation.

Simple math early retirement download#

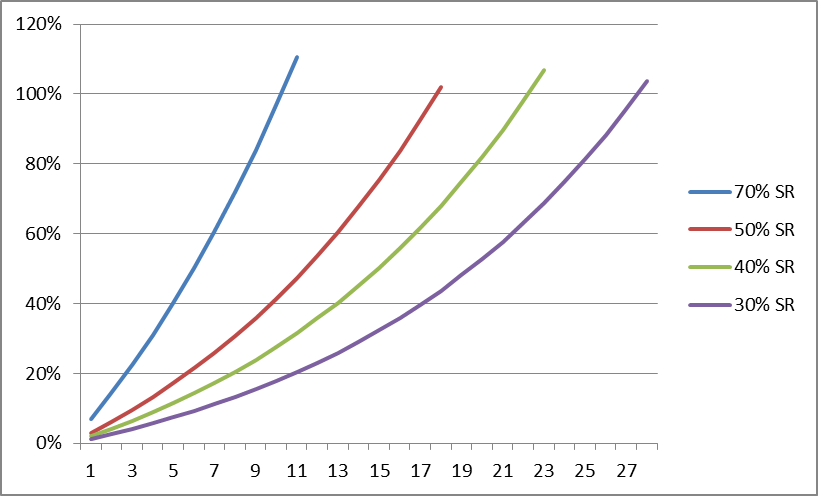

You can download it, and play with your own assumptions. You can view the spreadsheet behind the calculations from this link. This chart shows how long it would take for the investment income to exceed the amount of savings, given the return, the dividend growth, dividend reinvestment and savings assumptions.

0 kommentar(er)

0 kommentar(er)